Search experience team · Buyer’s tribe · 2024

After a long flatline in conversion, we unlocked a +1pp uplift through a new Filters entry point, and revealed a critical experience issue.

00 From intuiton to evidence

This project reflects my approach to problem-solving: starting from intuition and reinforcing it through research.

When my initial hypothesis wasn’t fully aligned across the team, I relied on data, benchmarking, and user interviews to build evidence and gain leadership buy-in.

01 Context

Wallapop is a leading marketplace in Spain, connecting buyers and sellers of second-hand items across a wide range of categories.

With millions of active users and high transaction volumes, the platform’s search and discovery experience is critical to match users with relevant products quickly and efficiently.

01 Problem

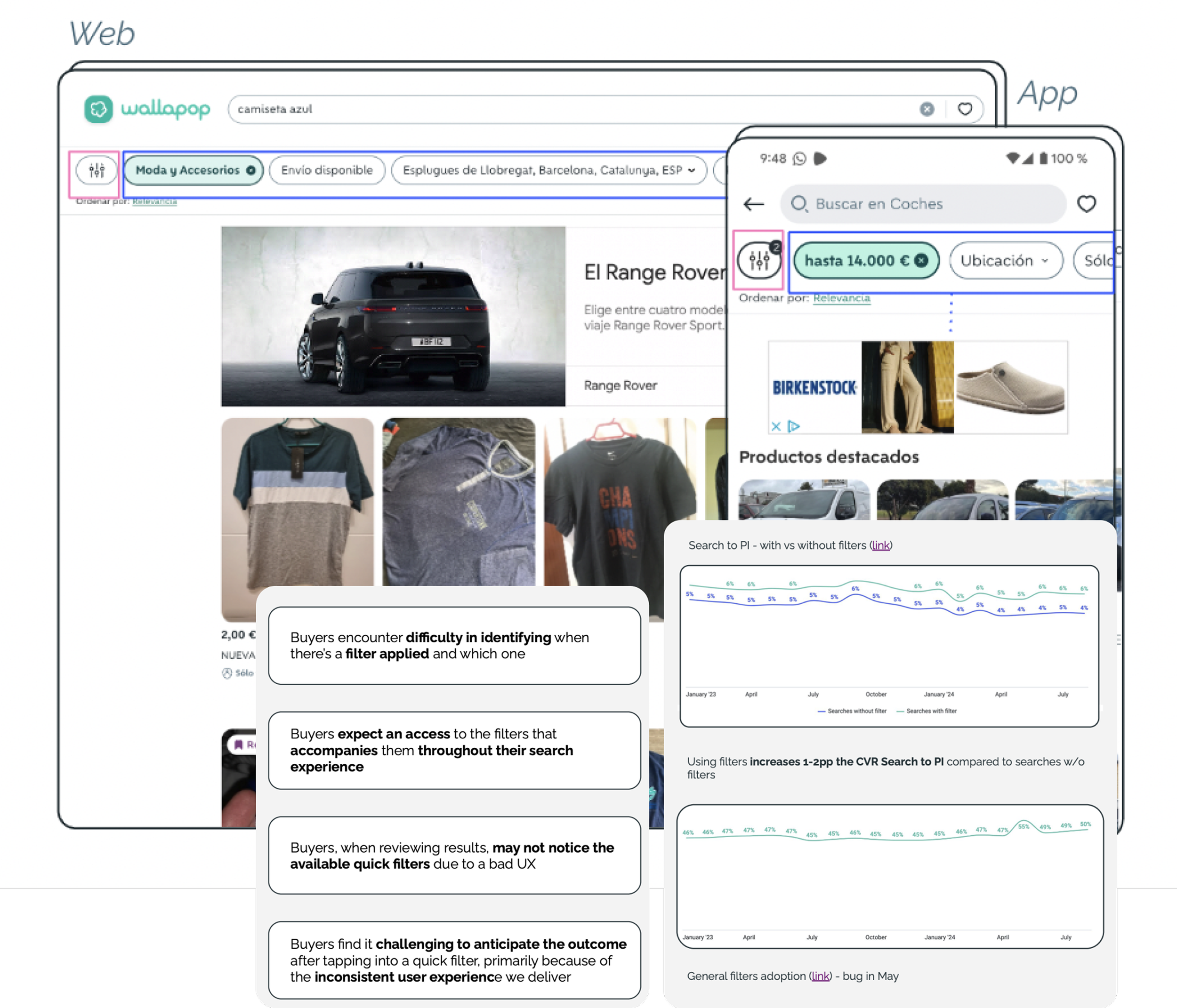

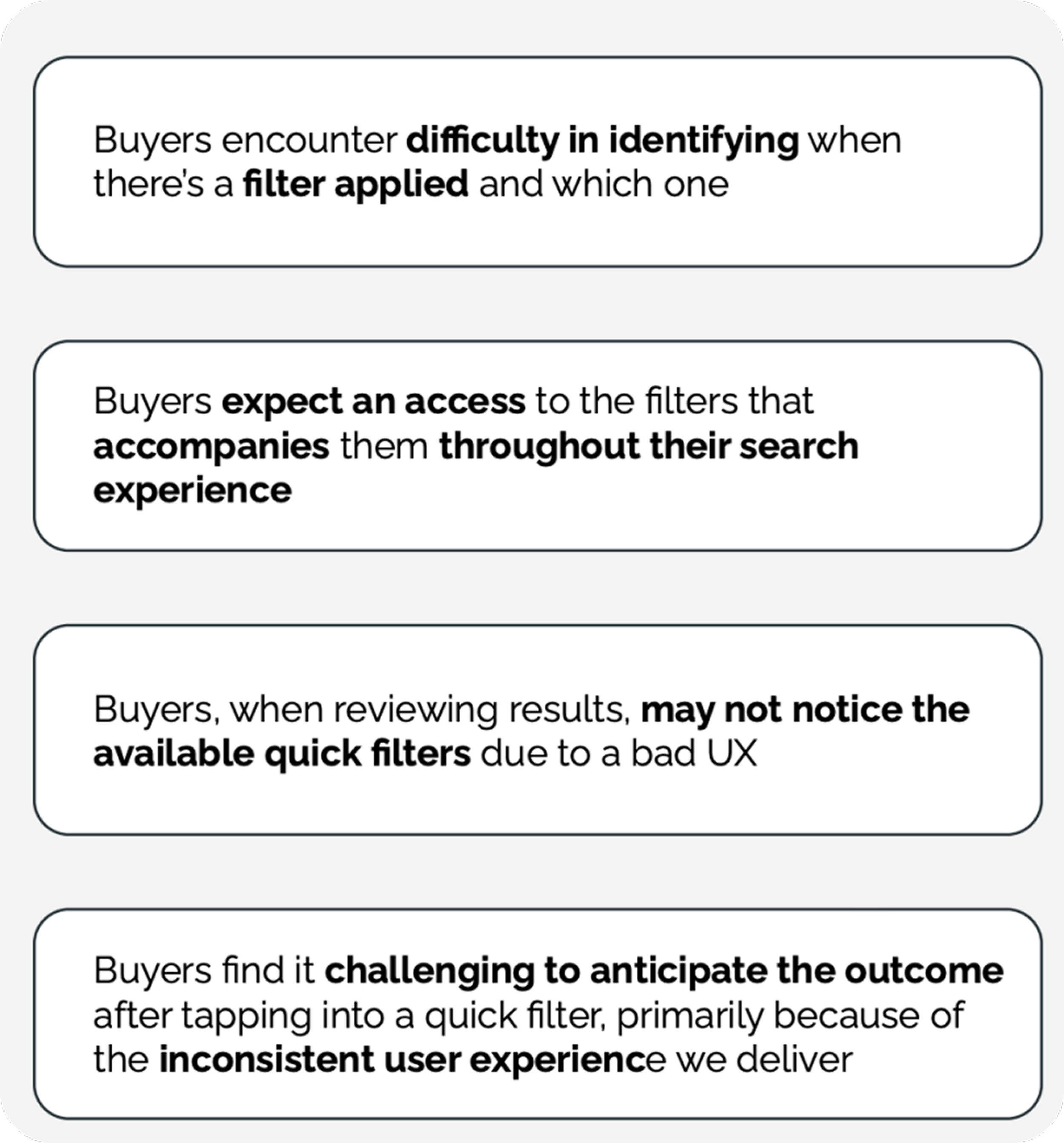

Buyers struggled with an inconsistent and unintuitive filter experience: duplicated entry points, low visibility, legacy constraints, and fragmented design across platforms.

As a result, adoption stagnated, conversion declined, and our ability to experiment and innovate was constrained.

02 Opportunity

We were enriching our catalog with new filter attributes, creating the opportunity to offer more filters and add richer context to the search experience.

This ✨ momentum ✨ allowed us to rethink the entire filters journey end-to-end, building a scalable and unified system across platforms.

We identified two key Jobs-to-be-Done around accessing and using filters. In this case study, I’ll focus on the first JTBD: accessing filters, while the second was successfully addressed and released (see bellow).

03 Process

Understanding

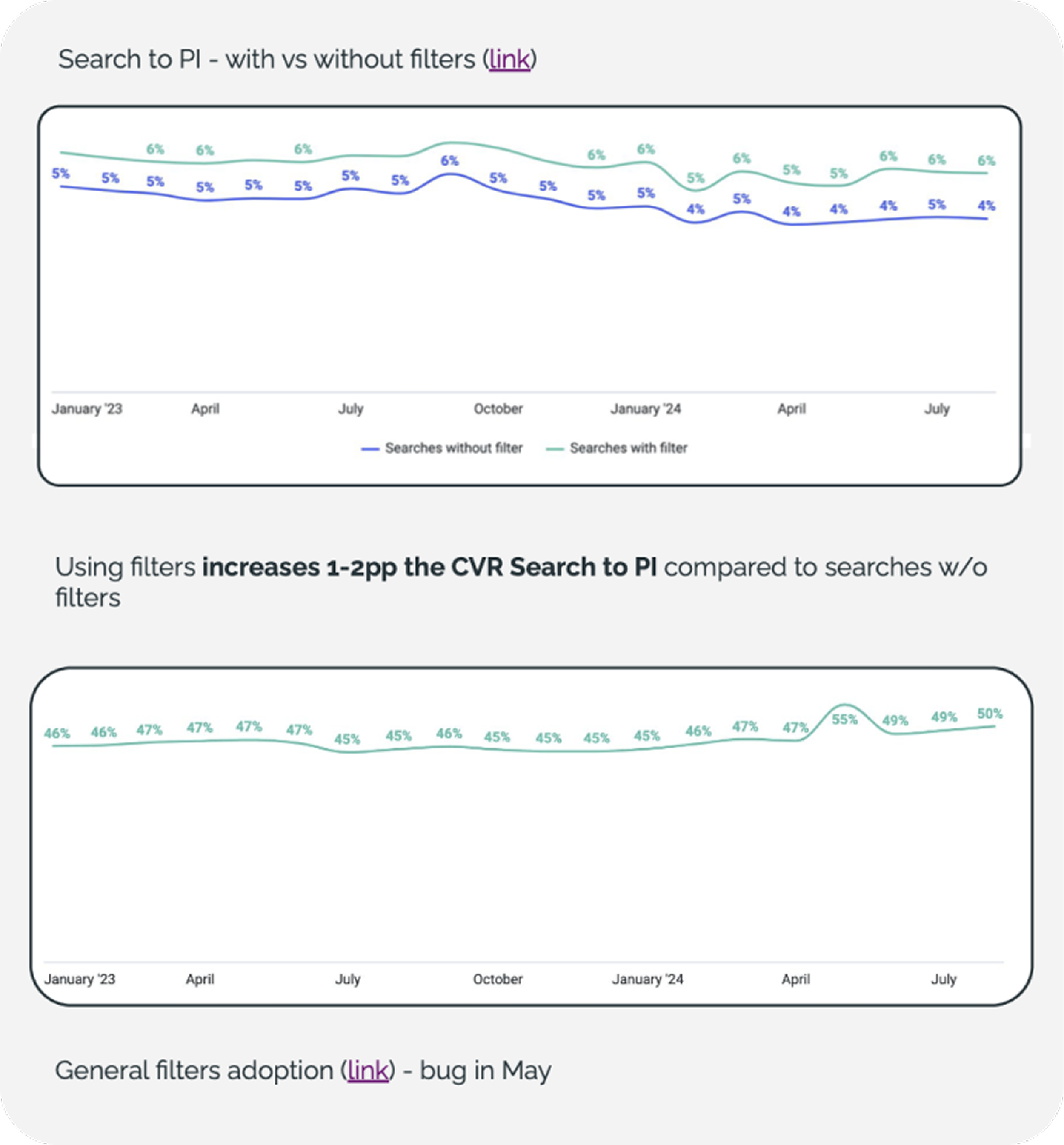

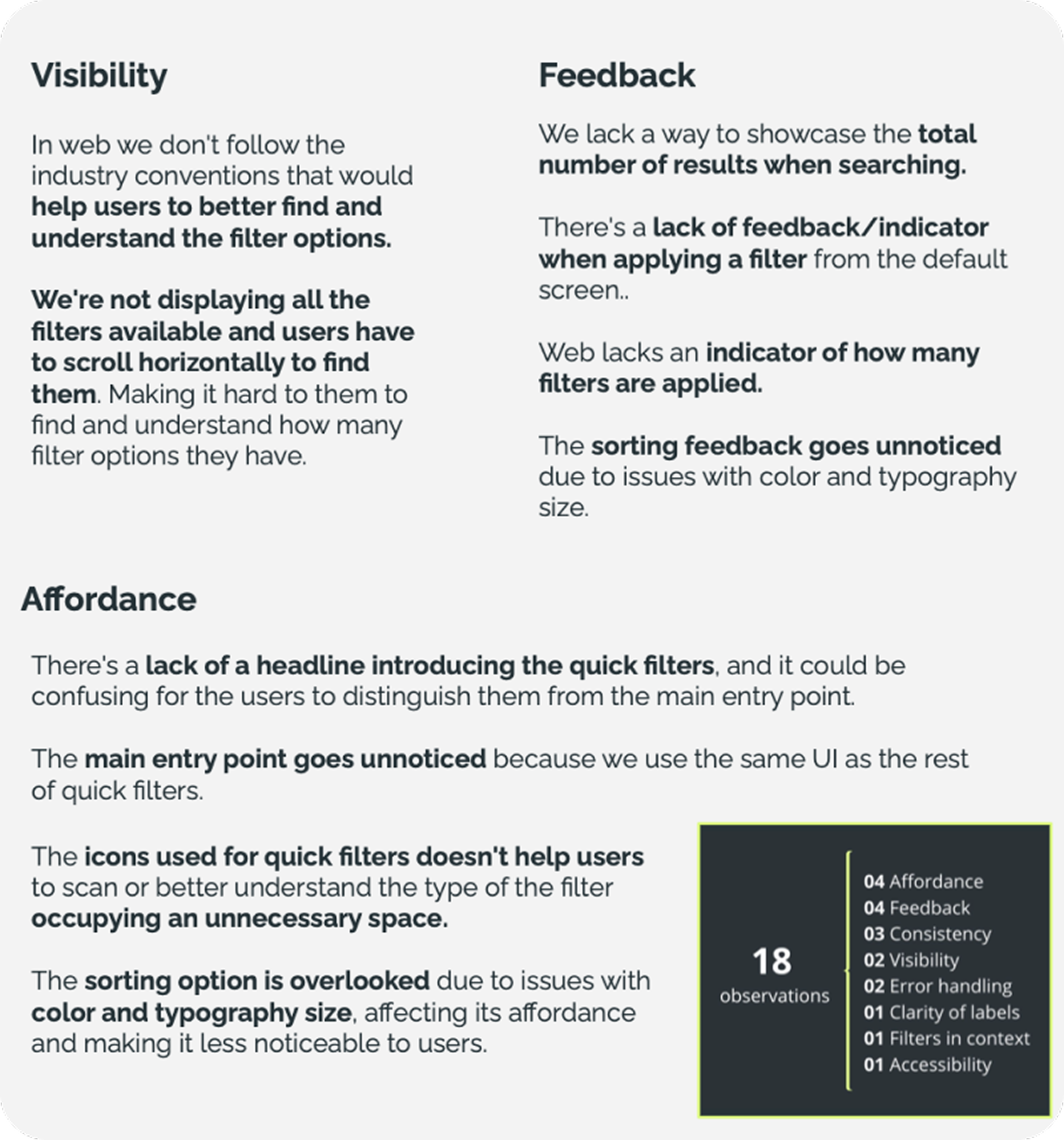

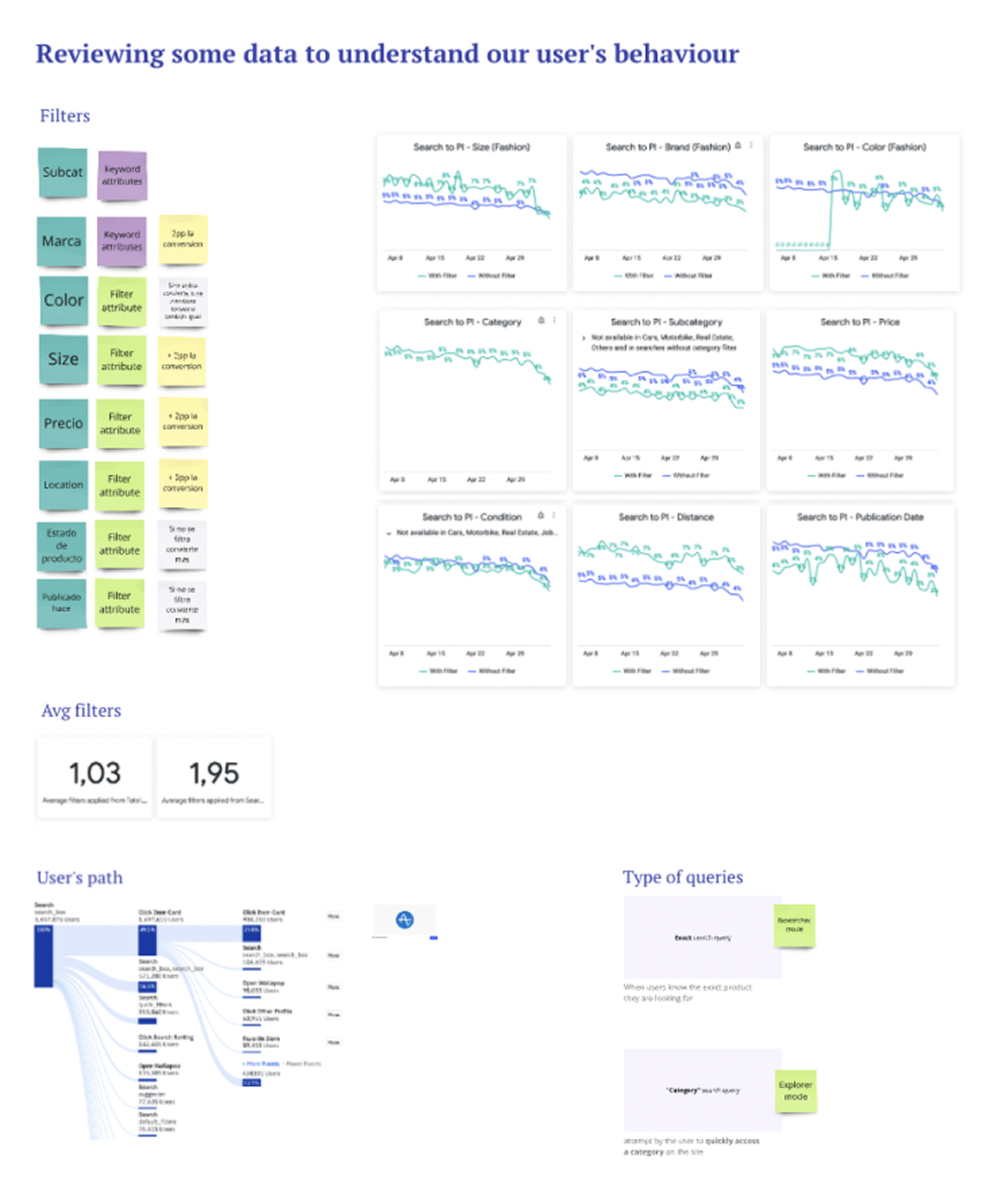

We gathered different data points, user insights, past experiments, and conducted a heuristic evaluation to better frame the current pains of the experience and its impact.

Benchmark

I did a benchmark to know how other players shape their search experience by analyzing the multi-platform strategy that they are following.

This resulted in two different layouts/concepts to be validated for both, web and mobile apps.

Definition

Based on insights from previous data and benchmarking, we identified different patterns and layout options to explore.

This step focused on defining and framing different solutions to validate across web and app, ensuring we considered platform-specific constraints and opportunities before moving into testing.

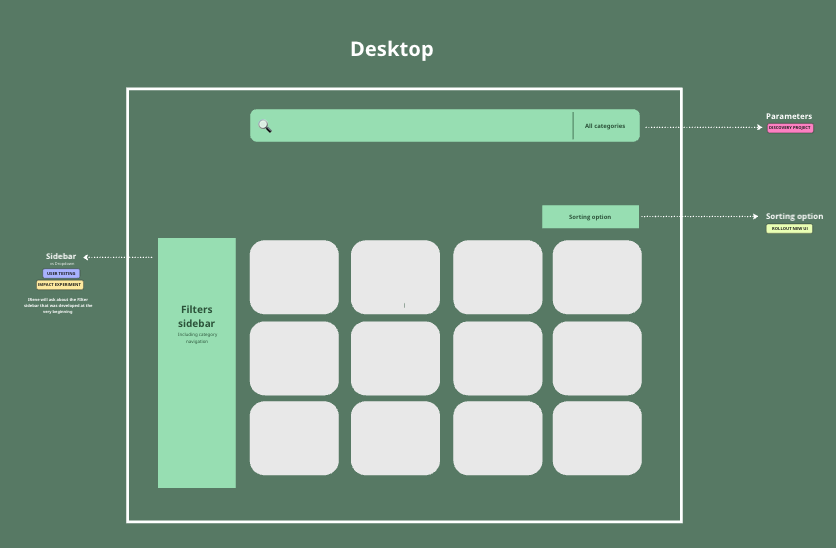

Desktop

We first planned to validate these two experiences through user interviews - to gain more confidence in the proposals.

Validation & delivery

I conducted 6 user interviews with buyers to validate the best filter experience in terms of visibility, usability, and awareness.

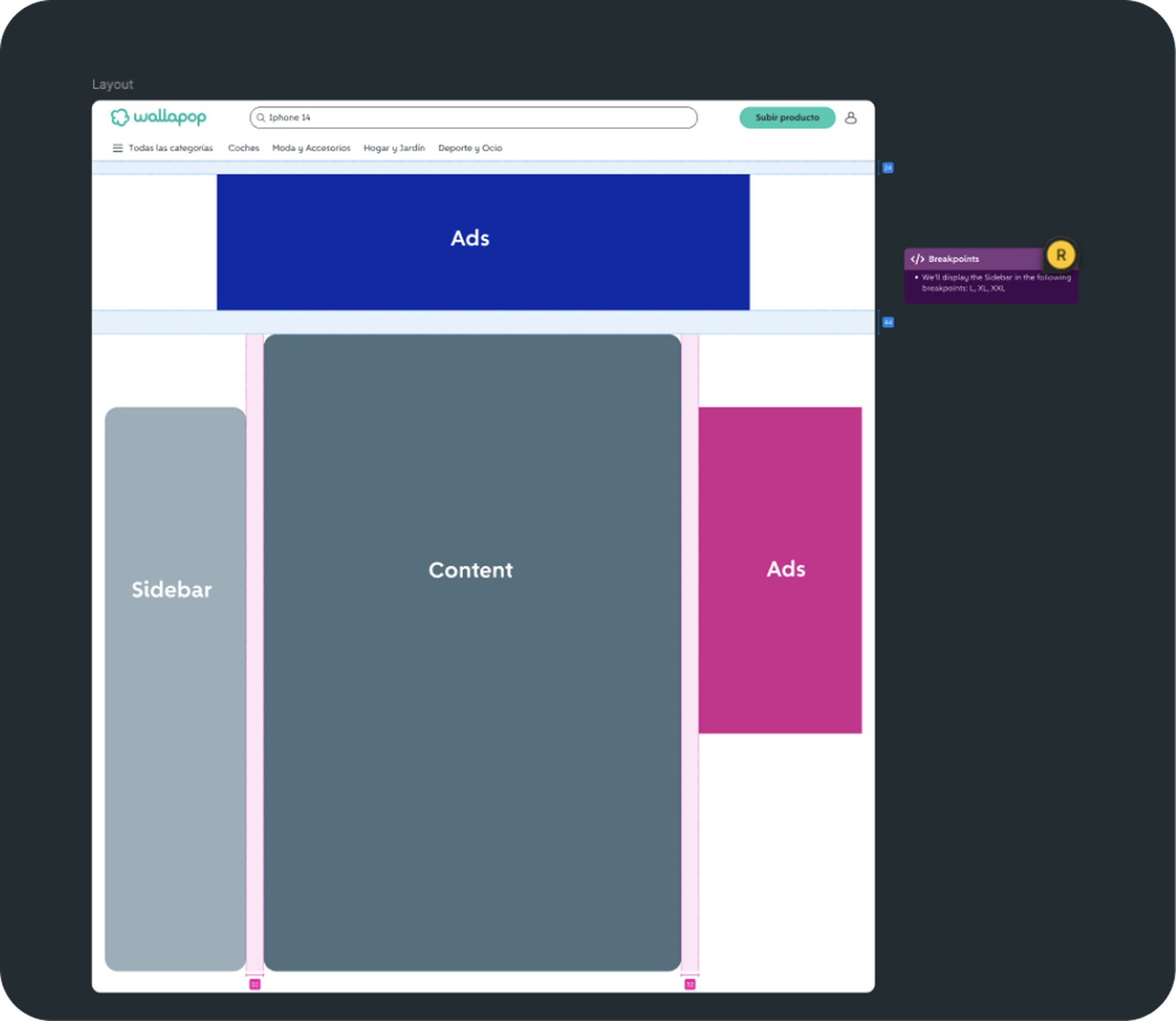

Our assumption was clear: we believed that the sidebar is favored on desktop because it makes browsing through filters easier, enables direct filtering, and uses the space efficiently.

The conclusions from the user interviews showed that users preferred the sidebar experience to narrow down their search.

User interviews helped reduce uncertainty and increased our confidence in the proposed direction.

Rather than treating them as final validation, we used these insights to make an informed decision to invest in development and move forward with an A/B test.

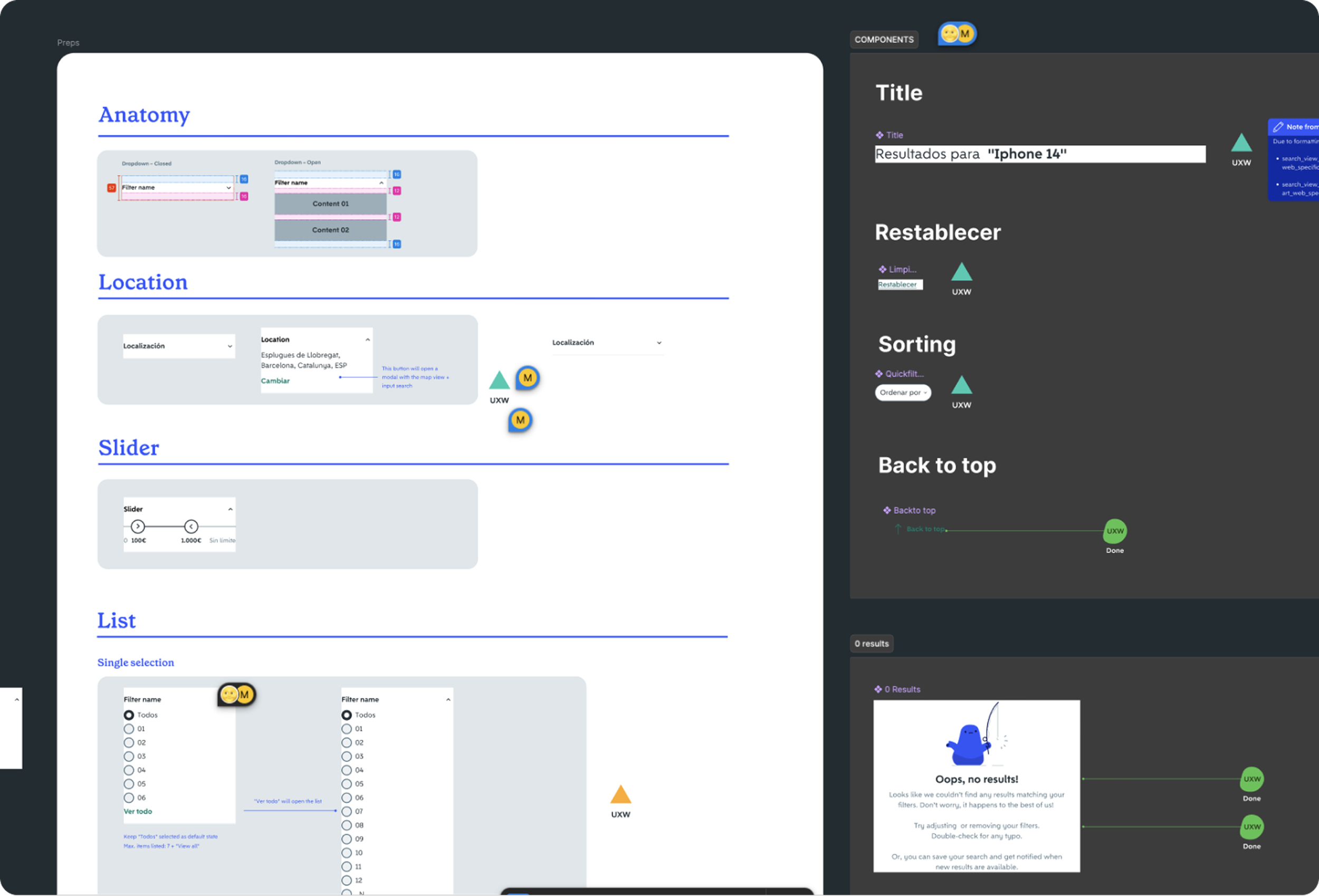

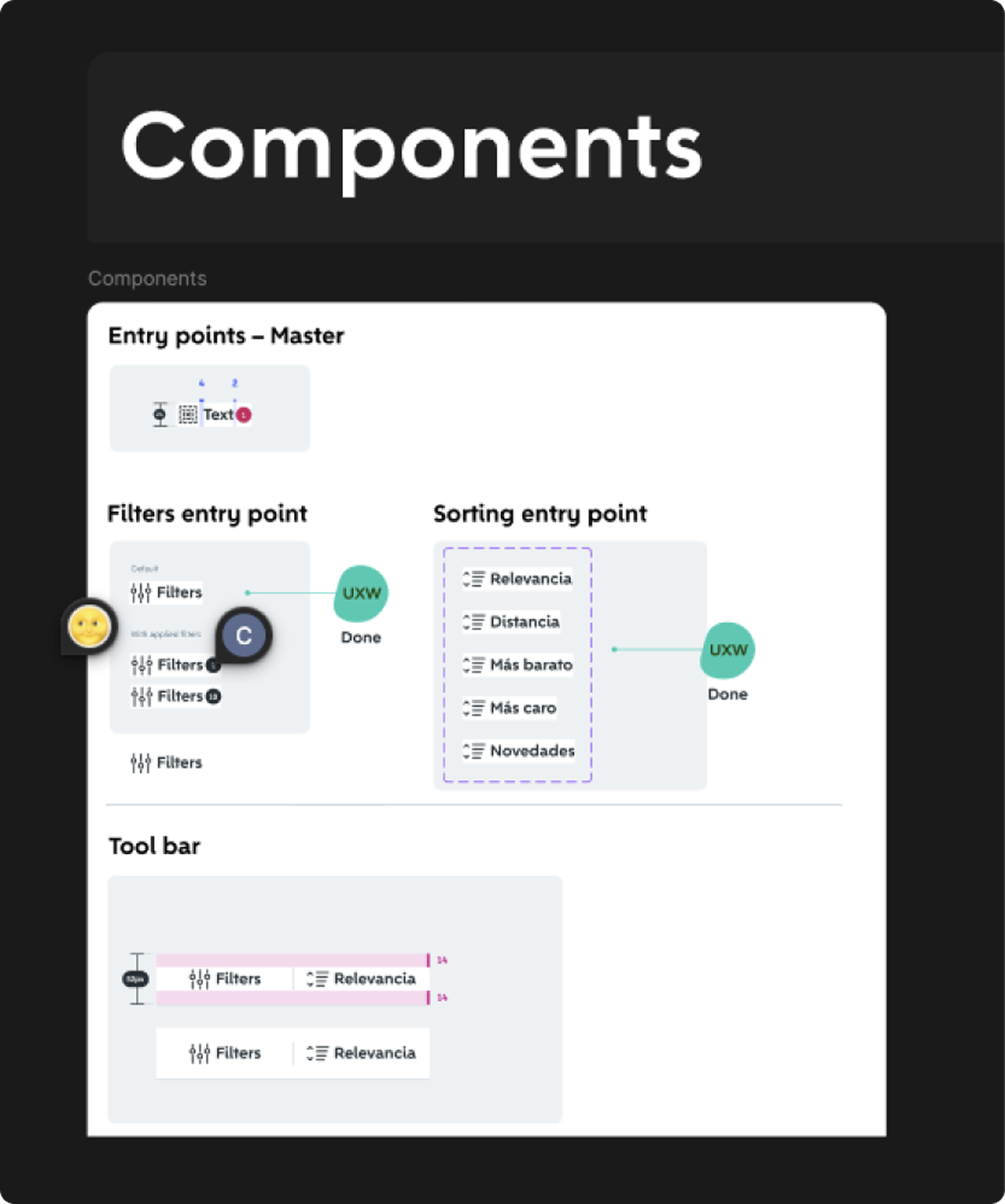

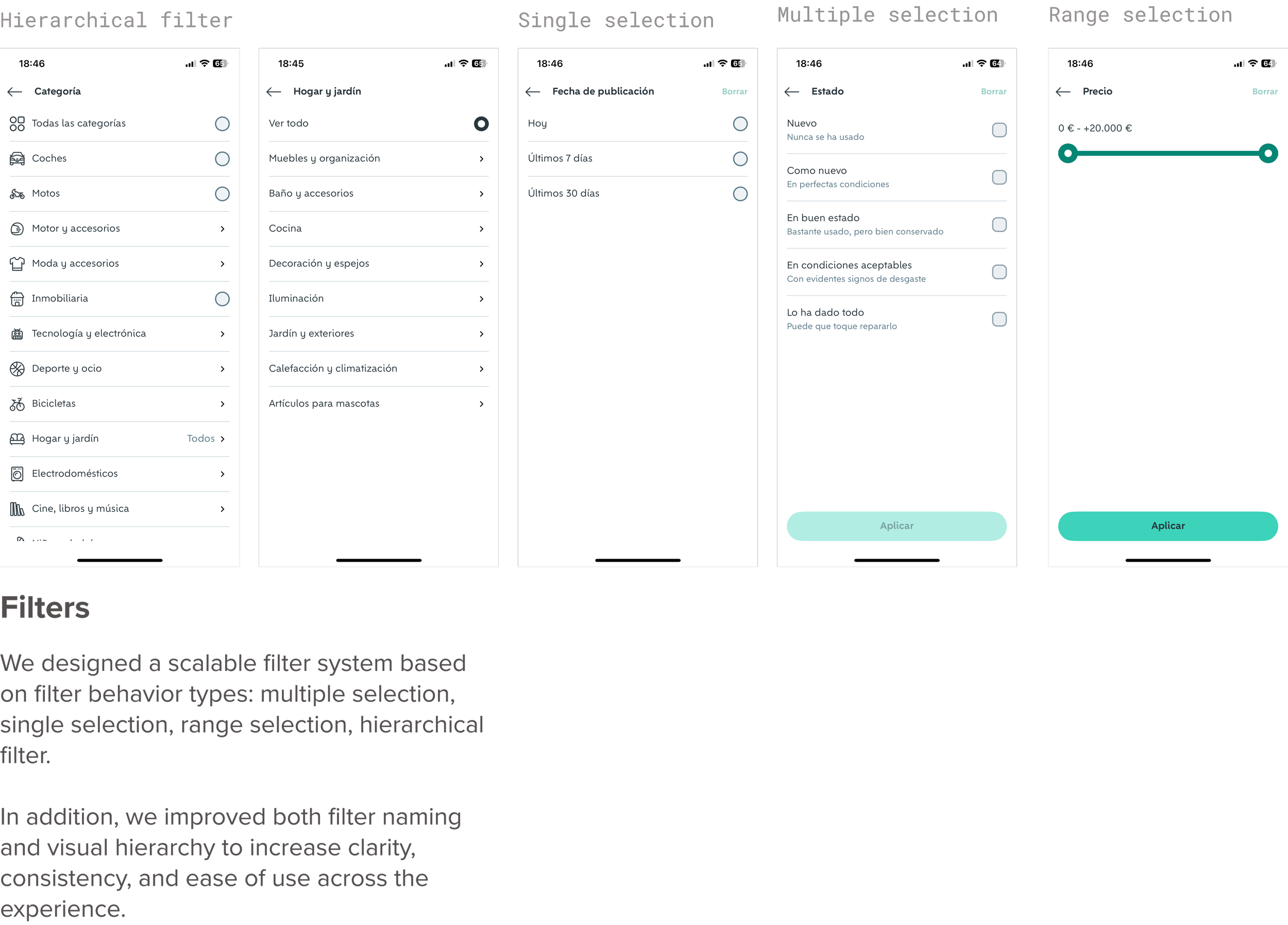

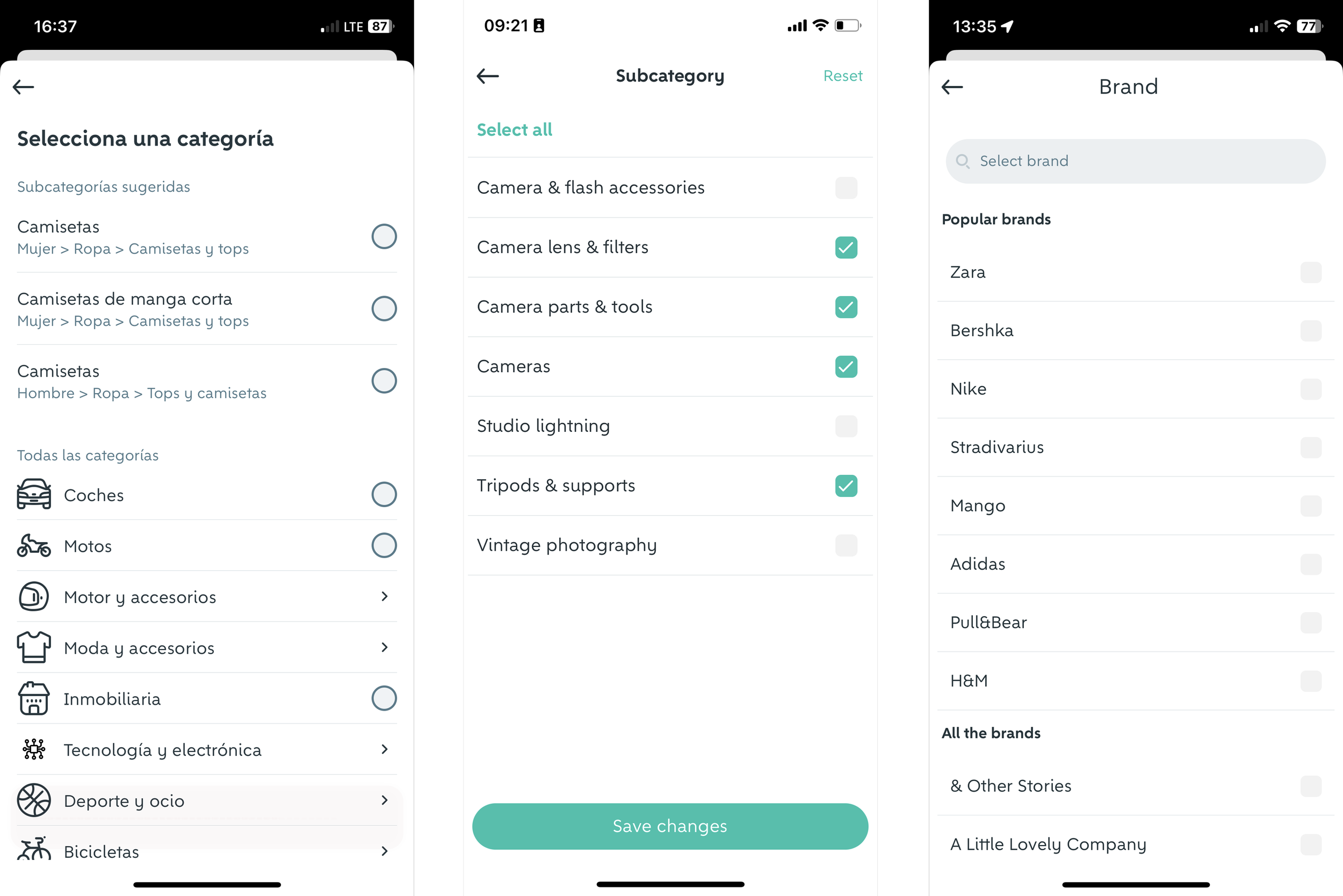

To reduce complexity and support scalability, we designed a system based on different filter types (e.g. single vs. multiple selection), ensuring consistency across platforms and a smoother development process.

One of the main challenges was integrating advertising into the experience. Since ads were a key revenue touchpoint, we worked closely with the ads team to ensure they fit naturally within the new layouts without compromising usability.

Impact

Impact

Filters adoption: +1.44%

Search to PI: -0.77&

Search to Intermediated TRX: +0.71%

Key learning

Despite a decrease in purchase intent actions (e.g. sending a message to the seller or clicking the CTA), we observed an increase in intermediated transactions.

This suggests that the improved filtering experience helped users narrow down results more effectively, leading to more confident, direct purchases.

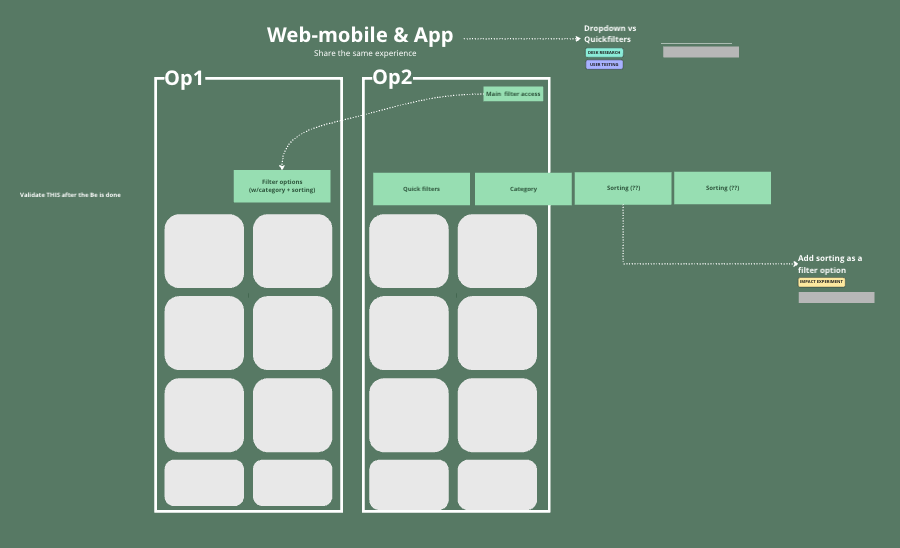

Web mobile & App

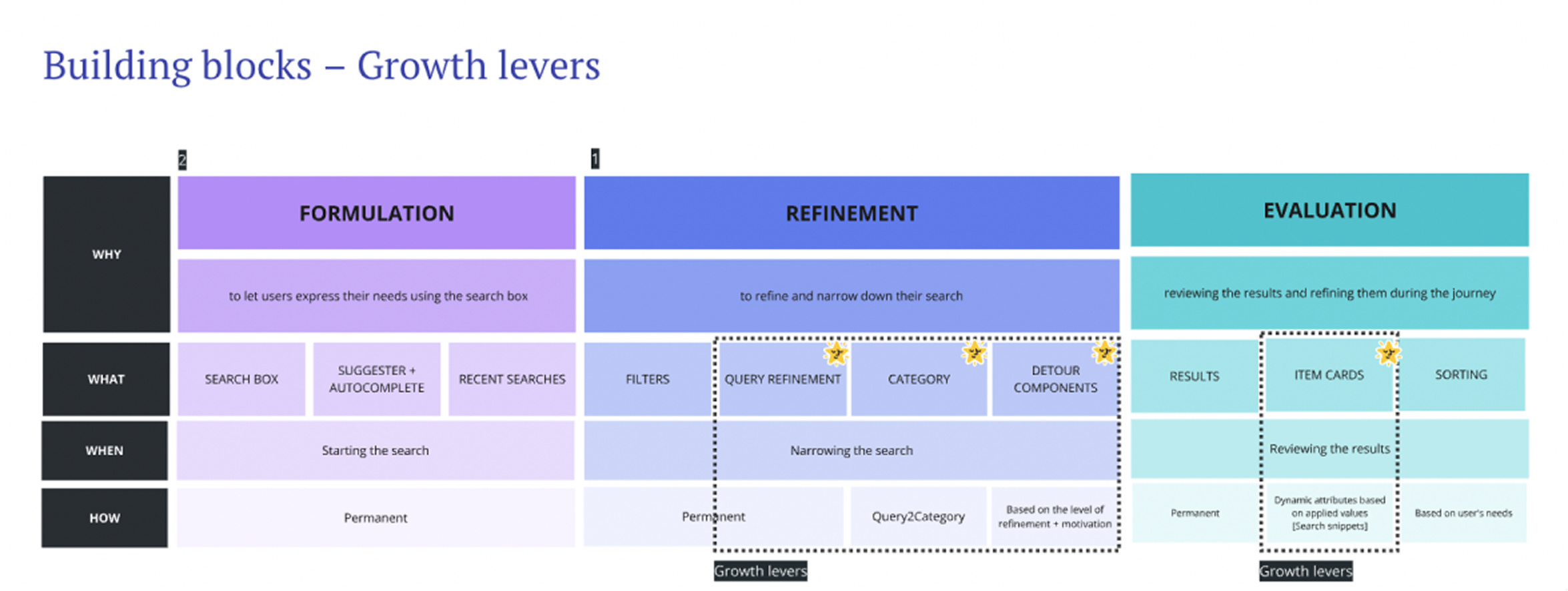

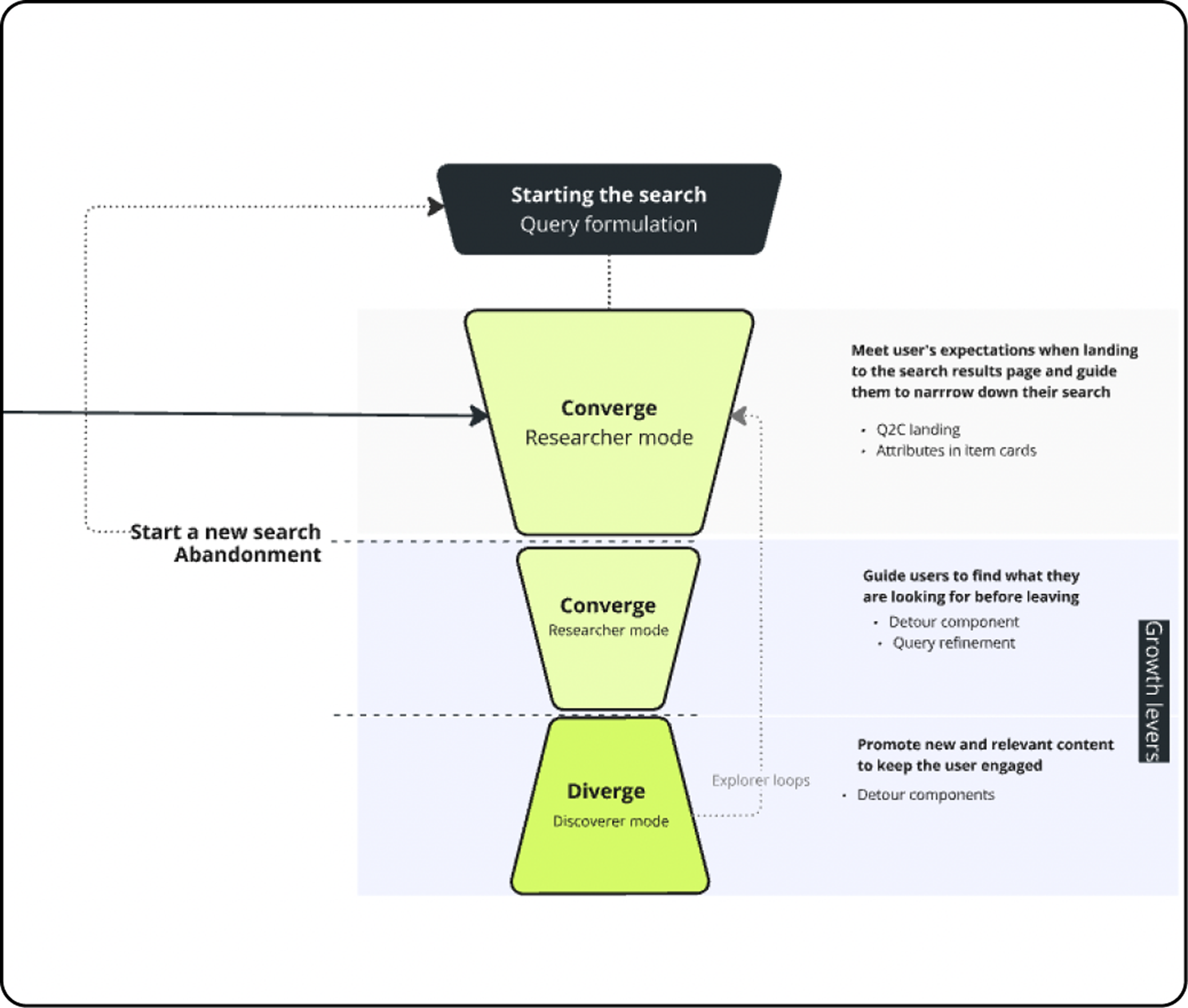

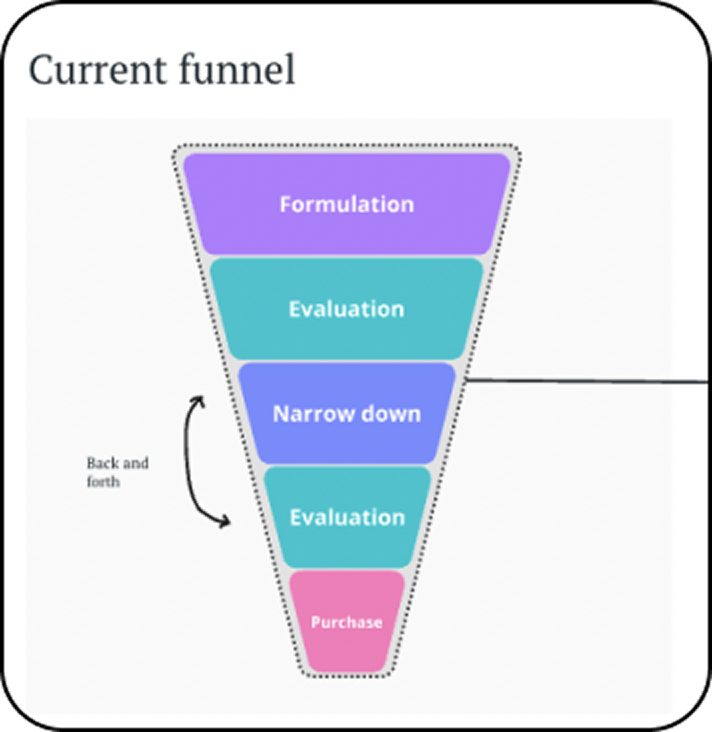

We developed a product vision to justify how this experience could help articulate potential growth levers and provide clear direction for our search funnel.

To shape this vision, we analyzed existing data, from which I extracted various user behaviour patterns – these patterns were key in identifying specific growth levers.

With all this information, I created a new funnel that incorporates those growth levers.

Envisioning

Design hand-off

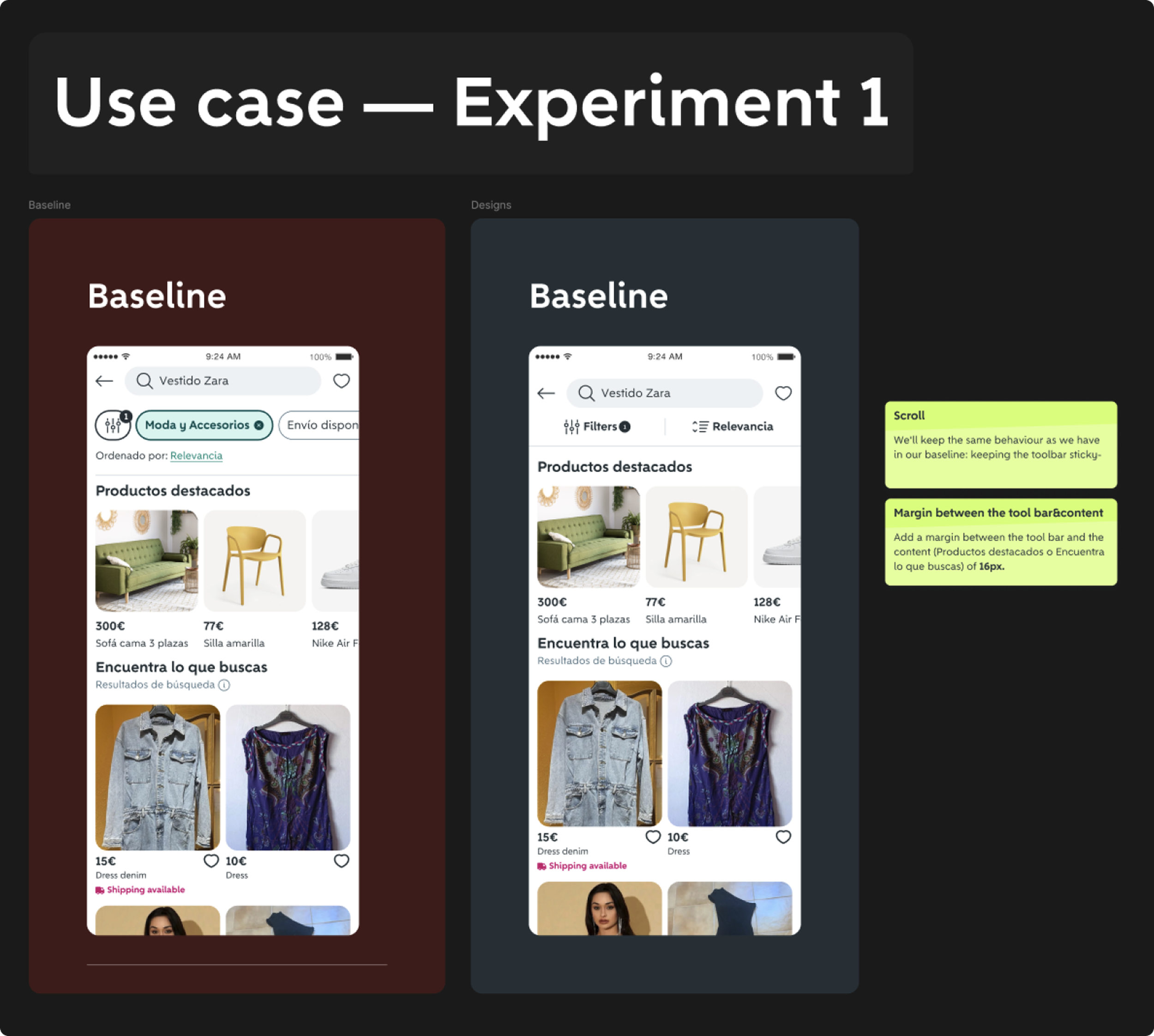

With this vision in mind, we proceeded to run the experiment with the Single Access approach once again, and I prepared the necessary specs for development.

For apps and web mobile, we chose the single access approach to simplify filtering and encourage users to explore all options in one place. This also opened the door for innovation and a more contextual, personalized experience.

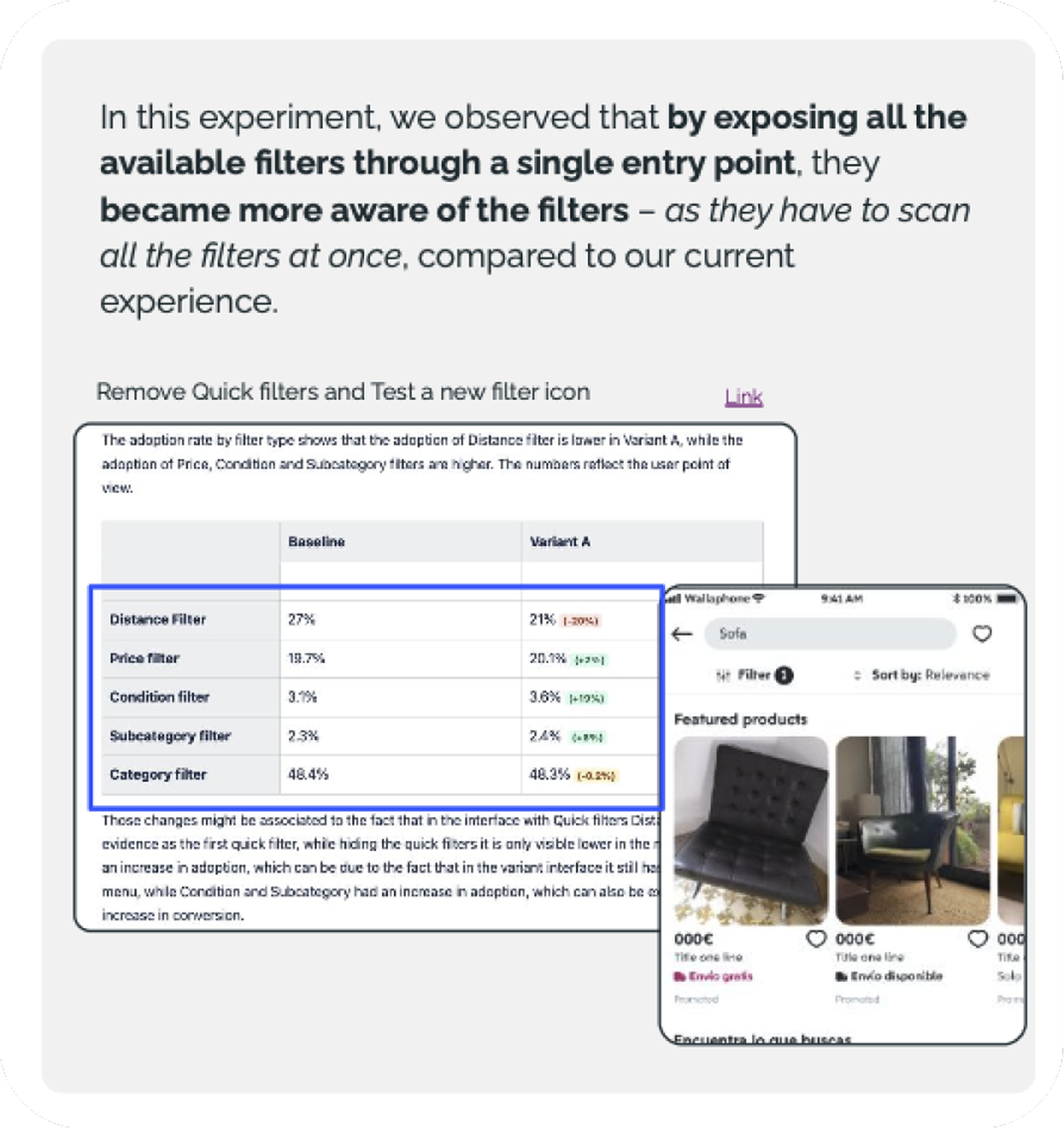

However, getting buy-in was challenging, as a similar experiment by the former Search XP team last year had inconclusive results.

Impact

Impact

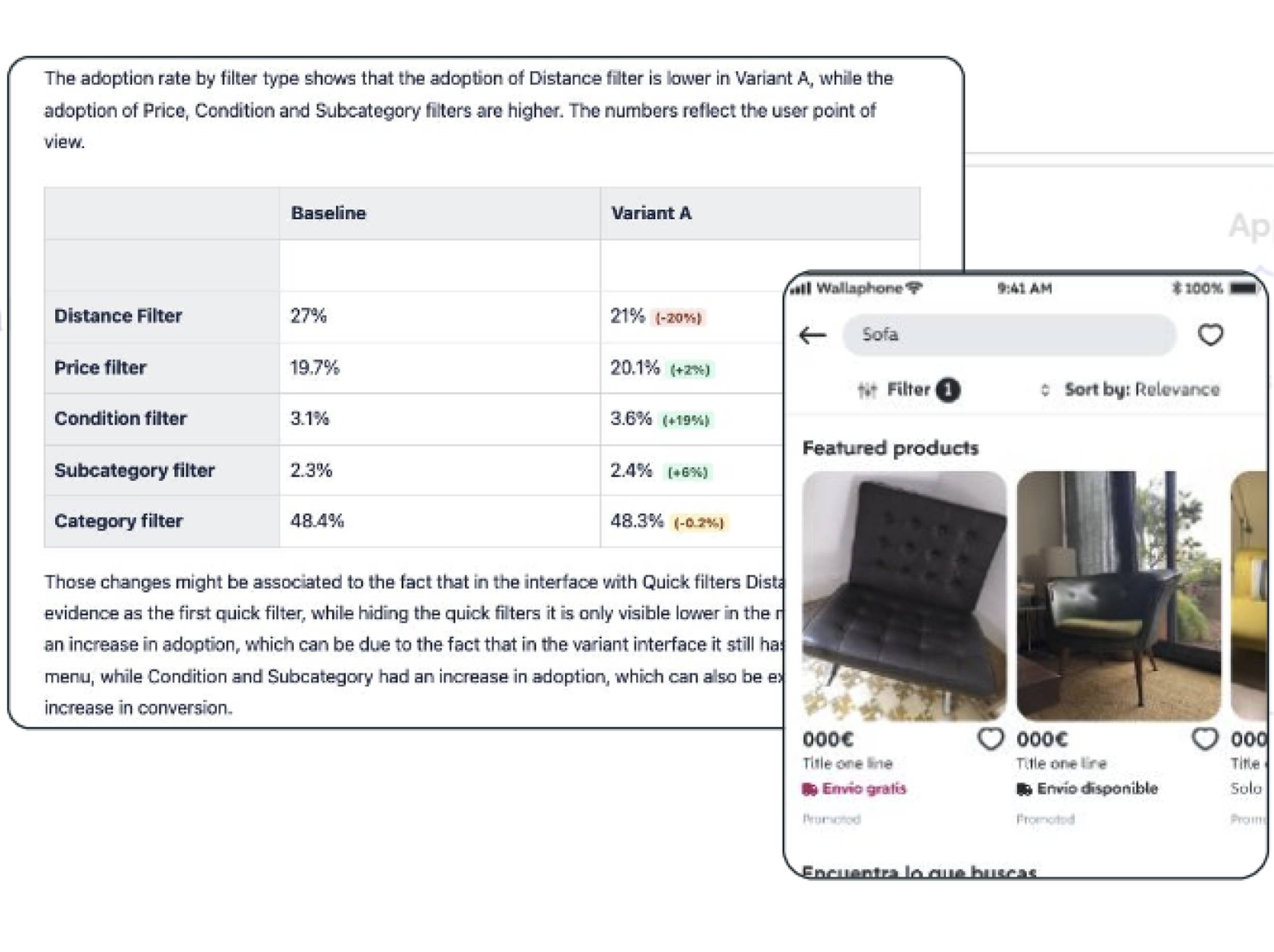

Filters adoption: -1.88pp*

Search to PI: -0.33pp

Search to Intermediated TRX: +1.05pp

*This drop is driven by the Location Filter, while adoption of the other filters has increased.

Key learning

Similar to what we observed on desktop, on mobile we saw that despite a decrease in purchase intent actions (e.g., sending a message to the seller or clicking the CTA), intermediated transactions increased. The only difference is the volume, which is higher on mobile due to greater traffic.

This suggests that the improved filtering experience helped users narrow down results more effectively, leading to more confident, direct purchases.

04 Next steps

We rolled out the two experiences in Web and Mobile.

You might be wondering.... but, in the end, you get a negative conversion, right?

Yes, we did, but we're now recovering, and also launching new experiments that could mitigate this negative conversion – based on the vision.

However, all these changes were worth making because they led us to an important assumption: despite the increased adoption of filters and launching a good experience, we saw a negative impact, which led us to believe that we had a problem with catalogue relevance.

We’ve already conducted several user interviews to better understand the issue of catalogue relevance, and this 2025, we'll be working on solving this issue to deliver the best experience buyers expect.

05 Personal notes – what I’ve learned :)

Speak the language of stakeholders - align with the vision and back it up with data and evidence.

A project can help you uncover new issues and start the process again.

Maintain constant communication with the team and stakeholders - the better the alignment, the more efficient and empowered everyone will be.

Sometimes we'll miss the mark in terms of impact, but the key is to have a plan for mitigation and recovery.

Always, always talk to users - they will show you the way (along with the data) :)

Think outside the box and challenge the status quo if your gut tells you to.

06 Bonus track (:

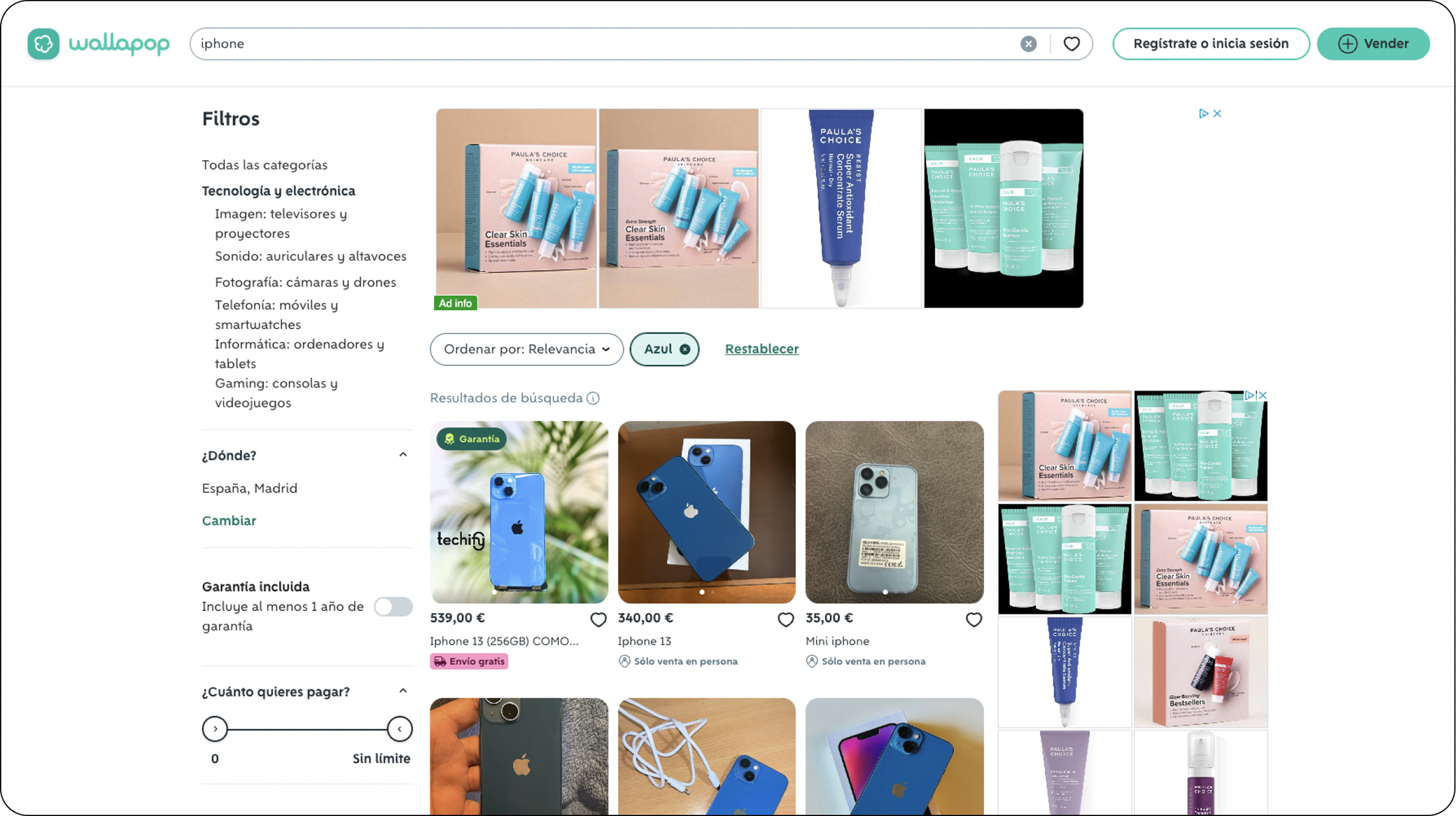

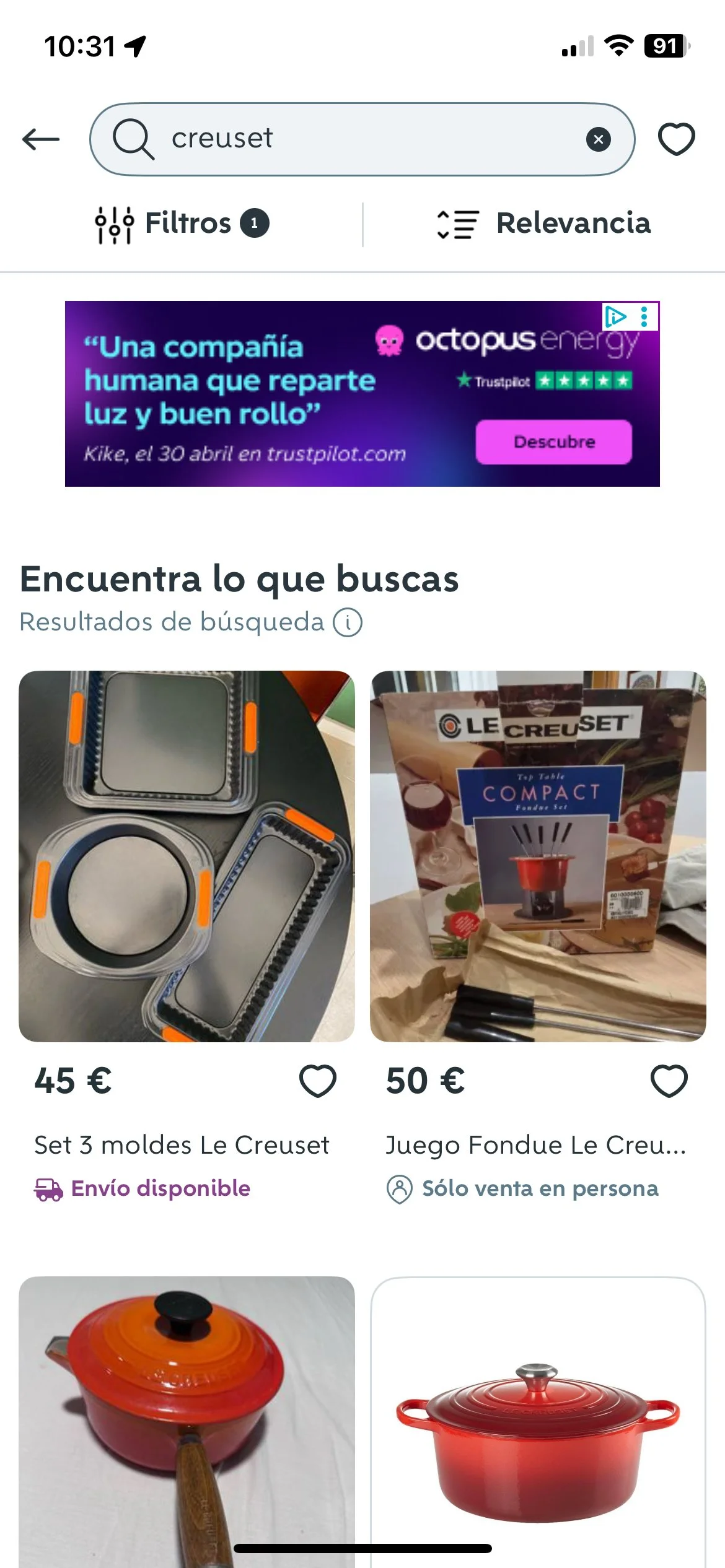

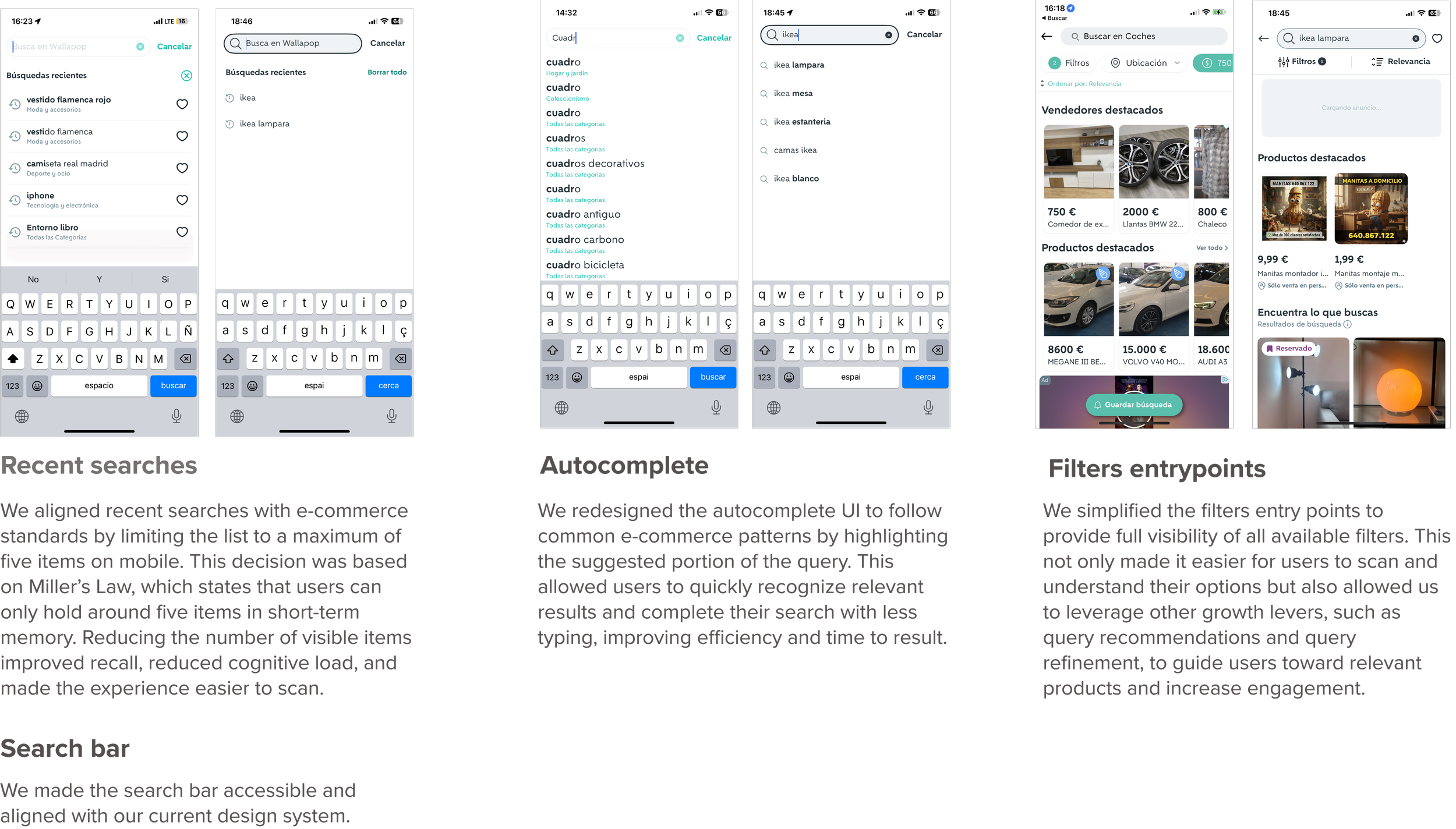

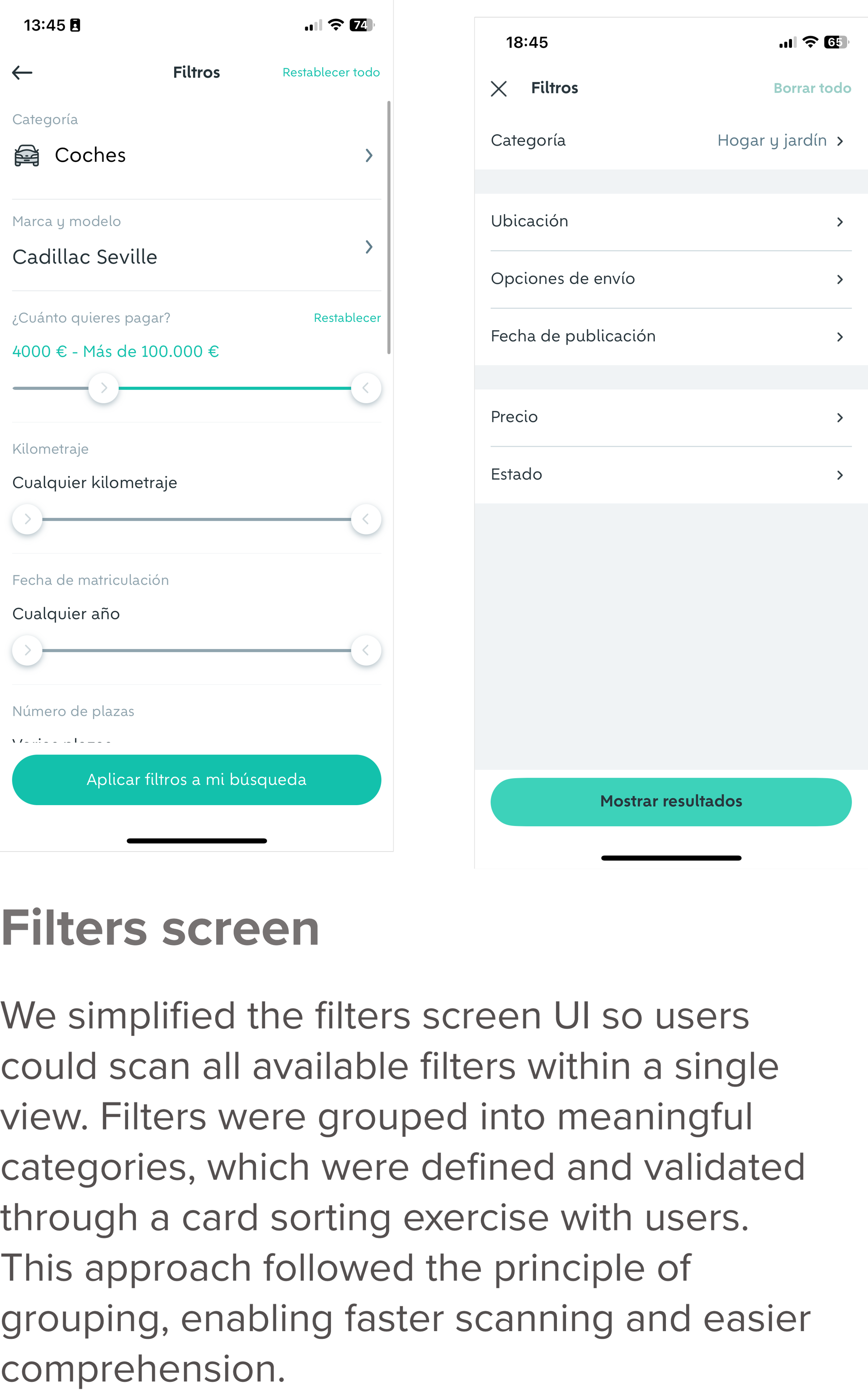

We also redesigned the entire search experience. The redesign focused on:

Improving overall usability and accessibility

Enhancing filter readability and scannability

Simplifying the overall experience

Adapting the search experience to e-commerce search patterns

Creating a scalable filter system to support different types of filters

Improving consistency across the experience

Improving the entry point to search

Improving content

More projects